The first thing you are likely to hear about Individual Retirement Arrangements (IRAs) is that they are: “tax deferred” accounts. Some may add that they provide: “compounded growth before being taxed”. This article refutes these claims and analyzes the actual tax benefits of IRAs:

- The ability to pay income taxes at a lower rate, if your income tax rate is lower at retirement.

- Money is investment-tax free (interest, dividends and capital gains), while in the IRA.

Identifying the actual tax benefits of IRAs is essential to decide between IRAs (called Traditional IRAs) and Roth IRAs. The decision between the two types of IRAs will be the topic of the next article.

What is an IRA?

Let’s start by defining an IRA: Individual Retirement Arrangement is a retirement plan account that provides some tax advantages for retirement savings in the United States. You can open such an account as a brokerage account, letting you invest in a similar way to other brokerage accounts. It has limitations on withdrawals, while providing tax benefits.

A Roth IRA, is an IRA that does not provide a deferral of income-taxes:

- Any money put into the account is taxed like the rest of your income.

- Any money taken out of the account is not taxed, like any other regular account.

Other differences between Traditional IRAs and Roth IRAs, as well as benefits specific to Roth IRAs, are left for discussion in the next article.

Potential Benefit: Tax Deferral

When putting money into an IRA, you can typically avoid paying income tax, letting the money grow for many years, until you withdraw the money. Let’s review the benefit of the tax deferral with an example. Note that this example is constructed to isolate the tax-deferral effect, leaving the other IRA benefits for a later discussion.

In this example a 50½ year-old person makes one $5,000 IRA contribution, and starting at age 70½ he starts making Required Minimum Distributions, until he dies at age 90½, and his heirs take out the full balance.

The first two years of withdrawals are detailed with 3 steps: (1) the account value before the withdrawal (reflects the investment growth), (2) the account value split to the amount to withdraw and the amount left, and (3) payment of income taxes on the amount withdrawn.

Later, two more summary lines are provided for 10 and 20 years into the withdrawal phase, followed by a full withdrawal by the heirs.

|

The Value of Tax Deferred Money

(Ignoring Tax-Free Gains, Income Tax Rate: 30%, Investment Growth: 17%)

|

| Point in Time |

Traditional IRA |

Taxable Account |

| Income earned |

$5,000 |

$5,000 |

| After putting into the account |

$5,000 |

$3,500 after income tax paid |

| Annual withdrawals at age 70½ |

Withdraw |

Left |

Withdraw |

Left |

| After 20 years of growth |

– |

$115,528 |

– |

$80,870 |

| Before withdraw 1/27.4 of account |

$4,278 |

$111,249 |

$2,995 |

$77,874 |

| After withdraw 1/27.4 of account |

$2,995 after tax |

$111,249 |

$2,995 |

$77,874 |

| After 1 year of growth (age 71½) |

– |

$130,161 |

– |

$91,113 |

| Before withdraw 1/26.5 of account |

$4,915 |

$125,320 |

$3,440 |

$87,724 |

| After withdraw 1/26.5 of account |

$3,440 after tax |

$125,320 |

$3,440 |

$87,724 |

| . |

|

|

|

|

| +9 years (80½), withdraw 1/18.7 |

$13,356 after tax |

$337,714 |

$13,356 |

$236,400 |

| +10 years (90½), withdraw 1/11.4 |

$52,673 after tax |

$782,563 |

$52,673 |

$547,794 |

| Heirs withdraw balance |

$547,794 |

$0 |

$547,794 |

$0 |

In the example above, we can see that tax deferral is not a benefit of IRA accounts at all. This is apparent by seeing that all numbers under the “Withdraw” columns are equal at all times. No matter how long the money is in the account, what the income tax rate is (as long as it is the same when contributing to the account as when withdrawing from it), what the investment growth rate is, and how you withdraw the money (how often and which amounts), you end up with the exact same amount of money for use during retirement.

How is this possible? It stems from the simple mathematical law: the order of multiplication does not affect the result. Here are both calculations of the value of the accounts if withdrawn after 20 years:

Traditional IRA: $5,000 x 1.1720 x 0.7 = $80,870

Taxable: $5,000 x 0.7 x 1.1720 = $80,870

Note that after putting the money into the account, and up until right before withdrawing the money, the IRA balance is indeed greater. This may be the source of the error of seeing tax deferral as a benefit. This is an error because you cannot use the IRA money without paying income tax on it. So, you are only fooled to believe you have more money, until after paying the income taxes.

How is this information useful? Since income tax deferral provides no benefit in IRA accounts, the deferral of income tax of Traditional IRA vs. no income tax deferral for Roth IRAs is not a reason to prefer Traditional IRAs over Roth IRAs. Only Benefit #1 below provides a reason to prefer Traditional IRAs in some cases (when the benefit exists and outweighs the extra benefits of Roth IRAs, as will be discussed in a future article).

Benefit #1: The Ability to Pay Income Taxes at a Lower Rate

If your income tax rate declines in retirement, the deferral of income taxes does provide a benefit. For example, if your tax rate goes down from 30% to 20%, you get:

Traditional IRA: $5,000 x 1.1720 x 0.8 = $92,422

If we divide this calculation by the original one (30% tax rate), we get:

Benefit = ($5,000 x 1.1720 x 0.8) / ($5,000 x 1.1720 x 0.7) = 0.8 / 0.7 – 1 = 14.3%

The benefit depends only on two numbers: the tax rate when the money is put into the IRA vs. the tax rate when the money is taken out. It doesn’t matter how fast the account grows, and it doesn’t matter if the money is in the IRA for 1 year, 40 years, or any other number of years.

On the other hand, if your income tax rate is higher in retirement, the use of an IRA creates a penalty. For example, if your tax rate goes up from 30% to 40%, you returns decline by: 1 – 0.6 / 0.7 = 14.3%

Note that the exact benefit depends on the tax paid on the full amount, which may include paying parts of the tax at higher brackets. This information is very important when comparing to a Roth IRA.

If you expect your tax rate to be higher in retirement, you can convert your IRA to a Roth IRA, to make sure you pay taxes at today’s lower rate, while keeping the other IRA benefits and more benefits specific to the Roth IRA that will be covered in a future article.

Benefit #2: Investment-Tax Free

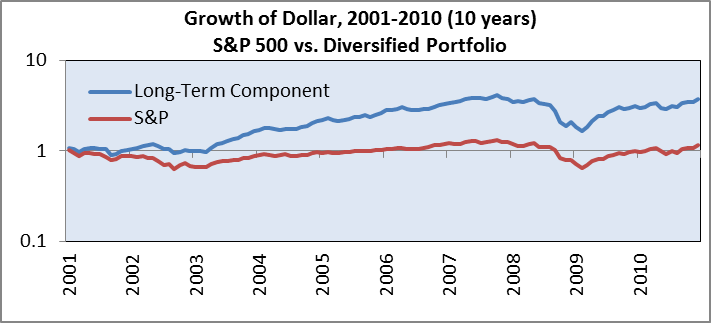

Any money put into an IRA, is free of investment taxes (interest, dividends and capital gains), for as long as the money is in the IRA. This provides a clear benefit that increases with the time the money is in the account. For example, say you are invested in a portfolio like Long-Term Component, and assume that the long-term growth is 17%, with 7% taxed each year, at a combined federal rate of 20% (mostly long-term gains and qualified dividends at 15%, and minimally short-term gains and non-qualified dividends), and state rate of about 10%. Your tax cost is 2.1% per year. The example above becomes:

Taxable: $5,000 x 1.1720 x 0.97920 x 0.7 = $52,898

If we divide the original calculation by this calculation one, we get:

Benefit = ($5,000 x 1.1720 x 0.7) / ($5,000 x 1.1720 x 0.98620 x 0.7) = 1 / 0.98620 => 53%

Summary

IRA accounts offer tax deferral of income taxes, which, contrary to common belief, is not a benefit. They do provide two other great benefits:

- The Ability to Pay Income Taxes at a Lower Rate: In case your income tax rate goes down by the time you withdraw your money, you get a benefit that depends on (and only on) the tax rate when withdrawing when compared to the tax rate when depositing the money in the first place.

- Money is Investment-Tax Free, while in the IRA: This is a substantial benefit that grows with the time the money is in the account, and grows with the investment taxes saved.

Disclosures Including Backtested Performance Data